Intelligent block trading

Total user control over pre-trade transparency, from dark to lit, providing users with command functionality to balance impact costs against trading opportunity costs.

Consolidating small cap liquidity

The complete universe of small cap liquidity: Tools for boutique investment firms and “professional” private clients, brings their block liquidity together with traditional buy-side and sell-side firms.

German market visibility for SME stocks

Trades execute on Xetra/ Boerse Frankfurt in parallel to the order-book, bringing block liquidity in German small caps back to Deutsche Boerse.

CCP settlement without the costs

CCP settlement through Eurex provides optimal risk management and settlement discipline, whilst netting by SideCaps removes the high CCP margins in small cap stocks.

Lower Costs

Mid-price matching, eliminates trading spreads.

Networking hub

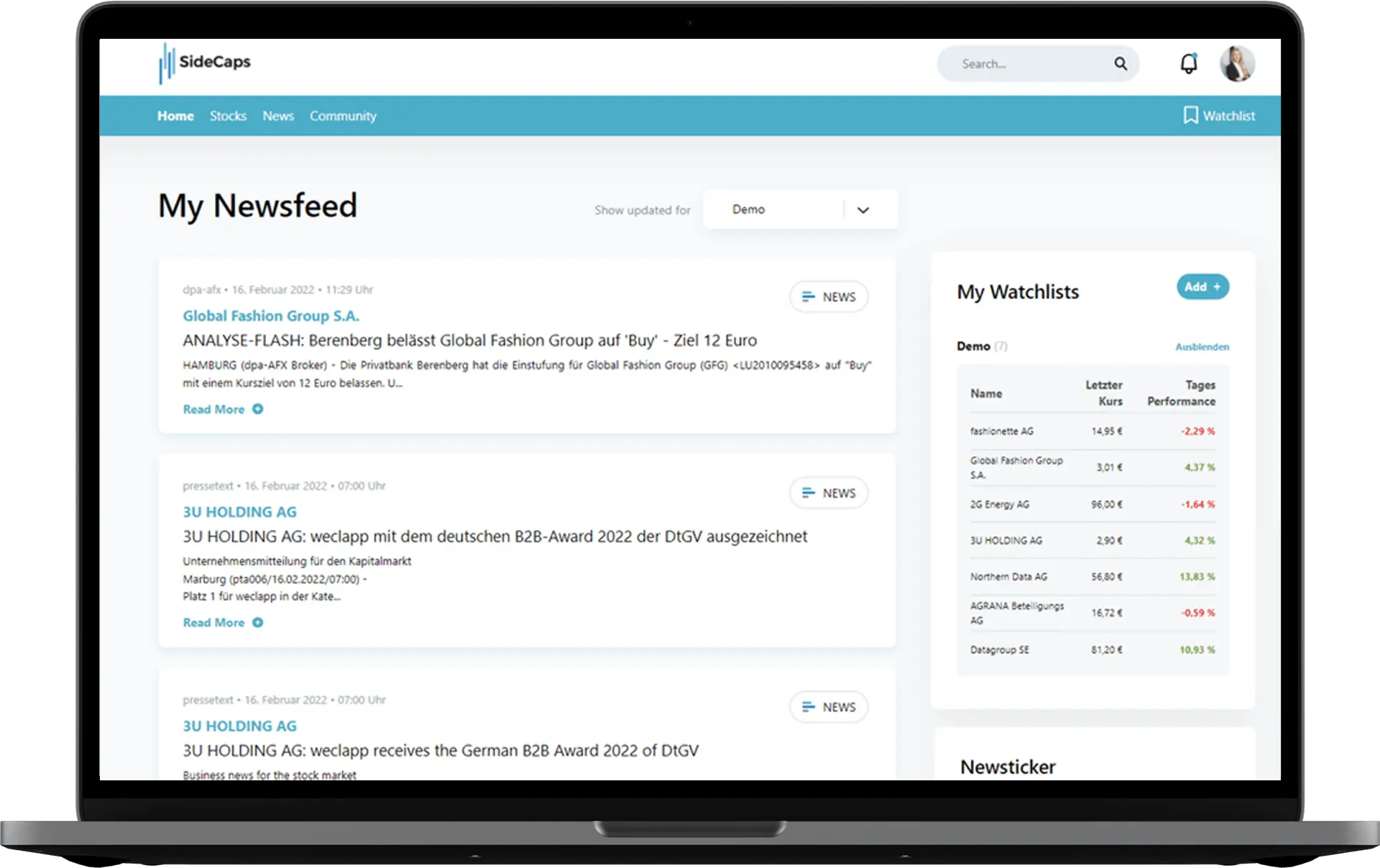

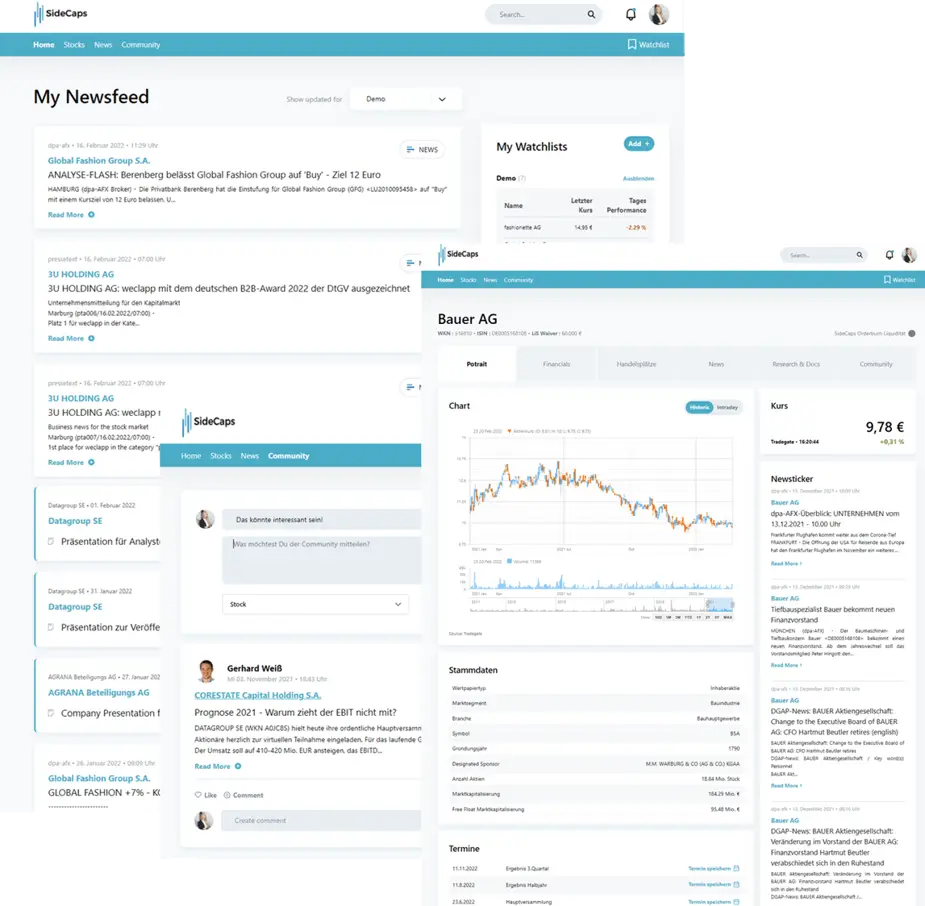

The only platform that links the whole SME eco-system from listed companies to investors to improve investment information flow.

Tailor made for small cap blocks

We’re laser focused on long-only, block trading, eliminating the room for toxic order flow.

Liquidity building information

Unique smart functionality builds liquidity in illiquid stocks and assists price negotiations with limited impact costs through private bi-lateral transparency.

This is SideCaps

“Reinventing SMEs and making large-volume investments in this attractive segment significantly easier and more transparent for all market participants.” This is the mission that has motivated us every day since our launch. By providing a holistic, digital ecosystem for listed small caps, we bring all players together and offer a comprehensive platform for the targeted procurement of information as well as the efficient initiation and execution of large-volume transactions.